How To Save Money Without Feeling Deprived. Smart Saving: 10 Tips to Build Your Savings Without Feeling Deprived. Savings Secrets: 10 Ways to Cut Costs Without Feeling Like You’re Giving Up. Financial Fitness: How to Save Money Without Sacrificing Your Quality of Life. Luxury on a Budget.

This site contains affiliate links. For more info, please see our full disclosure. This post has Amazon links and as an Amazon Associate, Peppermint & Co. Ltd. earns from qualifying purchases.

In today’s fast-paced world, saving money is more important than ever. However, the idea of cutting back expenses can often send the vibe of deprivation and sacrifice.

The good news is, with the right approach, you can save money without feeling like you’re missing out. In this blog, we’ll explore practical tips to help you achieve financial wellness while still enjoying life’s pleasures.

How To Save Money Without Feeling Deprived

Set Clear Financial Goals

Before you embark on your savings journey, it’s essential to define your financial goals. Whether you’re saving for a dream vacation, a new home, or retirement, having clear objectives will help you stay motivated.

In addition, set clear “how do I want to feel” goals. Setting a financial goal is great, but as we live life daily, we want to also find a way to enjoy our day by adding this bit to our plans.

What is the goal feeling this month? To feel appreciated? Maybe this means you’ll have to add some flowers from the groceries every week to your budget. Not the expensive ones, this can be a bouquet of $10 from your local grocery store.

If you want to also feel excited this month, maybe that means you have to add an extra $10 dollars every week to drive to local community events like jam sessions, walking around downtown, and getting an ice cream cone.

However this makes sense to you, adding $20-$40 a month to your budget to help you achieve your “goal feeling” will make your financial goals more inspiring and motivating to achieve.

Why? Becuase you don’t feel lonely and deprived.

It will also help to set a daily schedule. This doesn’t have to be too restricting. But sitting down for a few minutes to look at your finances will help you feel like you have a “handle” on things. Of course, we cannot control everything but you can certainly have a direction.

Include self-care moments as you schedule your daily activities. Financial stress is a significant source of anxiety for many people.

Feeling deprived can exacerbate this stress, leading to negative impacts on mental and physical health. By saving money in a way that doesn’t feel like deprivation, you can reduce financial stress and improve overall well-being.

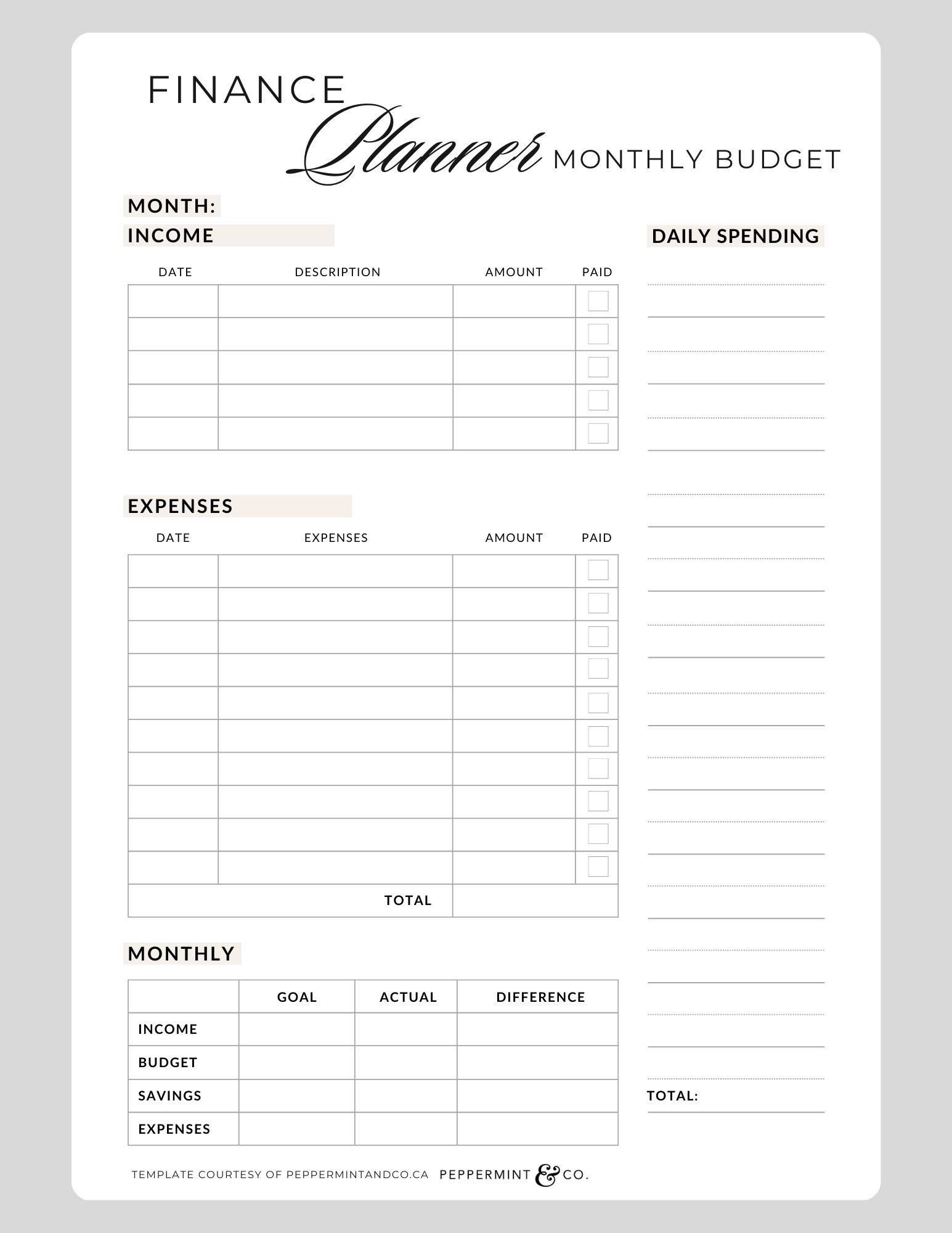

Create a Budget

A budget is a powerful tool for managing your finances and achieving your savings goals. Start by tracking your expenses and identifying areas where you can cut back.

Use online budgeting tools like spreadsheets, monthly budget tracking sheets, and apps that notify you when you are close to overspending. This will help you create and stick to a budget that works for you.

Opening up a credit card with a low limit to use for everyday purchases will help you stay on track. Also, will help you avoid debit and withdrawal fees as long as you pay before your statement date.

I am more of a pen and paper (millennial here!) and it gives me more impact when I use pen and paper to do my calculations. Here’s one of the sheets I use:

You can use this as a template to make your own using this link.

Here’s what a lot of financing websites tell you. You will have your daily spending challenged at times and creativity and agility will help you navigate them without feeling deprived. We’ll go over more of this point in detail as we go through this post.

When saving feels like deprivation, it’s challenging to maintain the habit long-term. Feeling deprived can lead to resentment and eventual abandonment of financial goals.

By finding ways to save money without feeling deprived, you’re more likely to stick to your saving strategies over time.

Practice Mindful Spending (How To Save Money Without Feeling Deprived)

Saving money doesn’t mean giving up everything you enjoy. It’s about finding a balance between financial responsibility and enjoying life’s pleasures.

By saving without feeling deprived, you can maintain a balanced lifestyle that includes both saving for the future and enjoying the present moment.

Mindful spending involves being intentional about how you use your money and focusing on what truly brings you joy. Before making a purchase, ask yourself if it aligns with your values and goals.

Moving your funds around to ensure you get to do the things that truly bring you joy.

What brings you joy comes in many different forms. If a new designer handbag brings you joy, that’s cool if that’s within your means and budget. Maybe pulling extra part-time hours to get that investment bag will help you fund it.

But simple joys might sound like only working part-time and living in a studio apartment but also being able to sip coffee along the shorelines while listening to the waves and watching the sunset.

This can also mean being able to afford a penthouse and working a lot to be able to travel when you want to.

Know what matters to you and what part of yourself (especially your inner child!) needs to be taken care of in order for you to truly experience joy and determine what mindful spending feels like to you.

Are we spending to feed our ego and tell people about how much money we have? Or are we spending on things and experiences that truly make our soul come alive?

Embrace Frugal Living (How To Save Money Without Feeling Deprived)

Living frugally doesn’t mean depriving yourself of enjoyment; it’s about making conscious choices to prioritize what matters most to you.

Look for ways to save money on everyday expenses, such as cooking at home, using coupons, and shopping sales.

This isn’t always easy. When I started making my drinks at home, I missed the “rush” and the “feel” of driving through a Starbucks and being around the morning rush crowd making me feel important and that I’m a part of a “hustle” professional group. Which was great at that time.

But as my priorities changed, I wanted a slower life where I was still able to enjoy my drink without spending money and without working full time all the time and continuously hustling.

So I decided to invest in a decent frother and kettle and dedicated a full 2 weeks to experimenting and practicing on what “kind” of drink I wanted to make at home.

It helped that I wanted to create something that Starbucks does not serve so I can have an “exclusive” at home.

I ended up creating 2 signature drinks for myself: Chamomile Vanilla Latte and Cinnamon Cardammon Latte. Both are caffeine-free because I no longer consume caffeine. I love both drinks so much that it was harder for me to even enjoy a drink at a Starbucks at a random time that I had to meet a friend for “coffee” because I’d rather enjoy my “drink” at home.

Cooking at home was also one of the hardest things to get into. I’ve realized that it’s not really about the discipline to cook at home that’s hard, but rather it’s the death of my old identity.

My old identity will always say yes when asked to eat out, check out a new restaurant, or have a drink. The moment I decided to make my own food and even pack my food when I went to outings, I started losing the chance to “connect” and spend time with my “friends” and honestly, even with family.

Sometimes if we want to embrace and develop ourselves into an evolved and mindful version of ourselves, we will have to shed our old lives, and that might mean need to find a new community or set of friends that will support who we are trying to be.

Doesn’t mean we have to “get rid” of everyone in our lives, but it means we will need to adjust how we spend our time with them.

Luckily for me, the very few friends that I have kept through 3 decades, have understood every change and evolution I went on; making it easier for me to adapt to different lifestyles for the seasons of my life that I am in without feeling like I am at risk of losing friends and connections.

I meal plan to save money but to also make my life easier, but at the same time, I didn’t want to “deprive” myself. This is why I do give myself treats like a cupcake or cookie for a great dessert place. I still hang around expensive places but only purchase the simplest and littlest things.

Just because you are saving money doesn’t mean you can’t be around expensive places.

I’ve been feeling “richer” being around expensive places and buying the smallest things within my budget. Am I going to order a steak meal at a high-end restaurant? Probably not. But a peppermint tea, yes, for sure.

Invest In The Right Kind Of Things

Hear us out here. Redefining your wardrobe and shoe collection to have well-rounded pieces will help you save money.

Creating monochrome foundational pieces like pants, dark wash jeans, white shirts, jackets, blazers, and blouses will help you create more dynamic outfits.

This will not only save you money but also save you time. Sticking to the “basics” is a great way to not only make you look polished but also to make your life much easier.

For the color and vibrant loving people out there, fear not, you can bring in colors and vibrant pieces through accessories like scarves, earrings, and belts.

I also don’t think you should not buy into the luxury goods sphere. I found that those are a great investment for your professional appearance and having them helps widen your reach especially if you are growing your business and network.

You want potential clients (especially if you have a business) to see that you recognize quality and know how to invest in them. This way they can also invest in your goods and services (your business) because they can relate to you and respect your eye for quality.

But do you need to buy more than one and blow your savings and income on them? No. But you can find classic pieces that are still within budget. You can do this by either tapping into the second-hand vintage market or looking for other designers that are within the entry-luxury level.

The same goes with shoes, investing in great quality flats, boots, and sandals will get you a long way.

If you are meal planning, invest in good food containers and fine china. This will help you feel more inspired than just eating from a plastic container.

Transfer your meal plans onto a great plate and serving set (we love those gold ones!). Set the table and savor your meal. Add garnishes and even put on jazz music to romanticize your day and keep you inspired.

The same goes for makeup and skincare (if you use them!). The fewer layers and piles you have, the less money you spend. Invest in great products that give you the coverage you need without layering so much.

A great foundation, concealer, blush, eyebrow gel, and lip balm will go a long way. Sephora has a great selection and not all of them break the bank. It is tempting to save money on these, but if you choose and invest in great products, the less of them you use which will eventually save you money in the long run.

Focus on Free or Low-Cost Activities (How To Save Money Without Feeling Deprived)

Saving money doesn’t mean giving up fun and entertainment. Explore free or low-cost activities in your community, such as hiking, visiting museums on free admission days, or hosting a potluck dinner with friends.

Cooking activities at home is a great start. Movie nights and nail painting nights at home are a great way to get your friends together without spending money out.

Creating a list of what you need for these low-cost activities is the way to go. If you are creating a menu for your planned activities, ensure that the rest of the ingredients will still be usable for the rest of the meals you planned for the week.

I’ve also found that going to local community jam sessions is a great way to enjoy music without spending a lot. Also a great way to meet new people and create new friendships.

Eventbrite has lots of local listings for events and some of them are free.

Some theatres are more affordable on Tuesdays and that will save you lots of money. Drop by the dollar store to pick up small bags of treats to bring with you and you can enjoy the movie for under $10!

In Toronto, Cineplex now offers $5 movie tickets on Tuesdays.

Automate Your Savings

Take the guesswork out of saving by automating your savings contributions. Set up automatic transfers from your checking account to your savings account each month.

Additionally, consider participating in employer-sponsored retirement plans or setting up automatic contributions to a retirement account.

Ask your bank on how these can be set up. Don’t go overboard to a point that you don’t “see” or “feel” the fruits of your hard work. It’s good that you get a chance to “see” this account growing to keep you inspired.

Surround Yourself With The Right People

We’ve mentioned this already earlier. You must be surrounded by people who will not judge and most importantly, laugh and mock your “new” way of living. How To Save Money Without Feeling Deprived.

If people around you stunt your growth and evolution, it is not worth it to be around them anymore.

Sometimes starting alone again and growing into a new community of people who support your new journey will help.

This might mean you will have to seek out community and put yourself out there to find new groups that can contribute to the new person you are becoming.

How To Save Money Without Feeling Deprived

Saving money is a marathon, not a sprint. It’s essential to develop sustainable saving habits that you can maintain over the long term. By saving without feeling deprived, you set yourself up for long-term success and financial security.

Achieving financial wellness doesn’t have to mean feeling deprived. By setting clear goals, creating a budget, practicing mindful spending, embracing frugal living, enjoying free or low-cost activities, and automating your savings, you can take control of your finances while still enjoying life’s pleasures.

Remember, small changes add up over time, so start implementing these strategies today to secure a brighter financial future.

Essentially, you are entering into a season of your life where old habits no longer serve the goals you want to achieve. The most challenging part about this is that you’ll have to let go of those old habits.

It will be tricky and challenging which is why it is important to be kind to yourself as you go through this evolution and growth.

People will tell you, you need to enjoy life and you only live ones (YOLO), and just a lot more things that might derail you with your financial plans. But your aim is to live your work life and real fun life harmoniously. Meaning, your enjoyment of life might now be different from how others enjoy theirs.

Comparison is a thief of joy. But is also a great way to be inspired if done right. The balance lies in how you balance strategies and allow for both saving and enjoyment.

** This post has Amazon links and as an Amazon Associate, Peppermint & Co. Ltd. earns from qualifying purchases.